An itemized deduction is a tax deduction for which you may be eligible. You may have itemized deductions for certain activities, charitable contributions, and other taxes. To claim them, you simply need to compute the total amount and compare it to the standard deduction. Then you can subtract the more than the standard amount from your adjusted gross income. Although the standard deduction is the baseline, itemized deductions are more targeted to your personal circumstances. They have been part of federal income tax law for many years, but have undergone several changes over time.

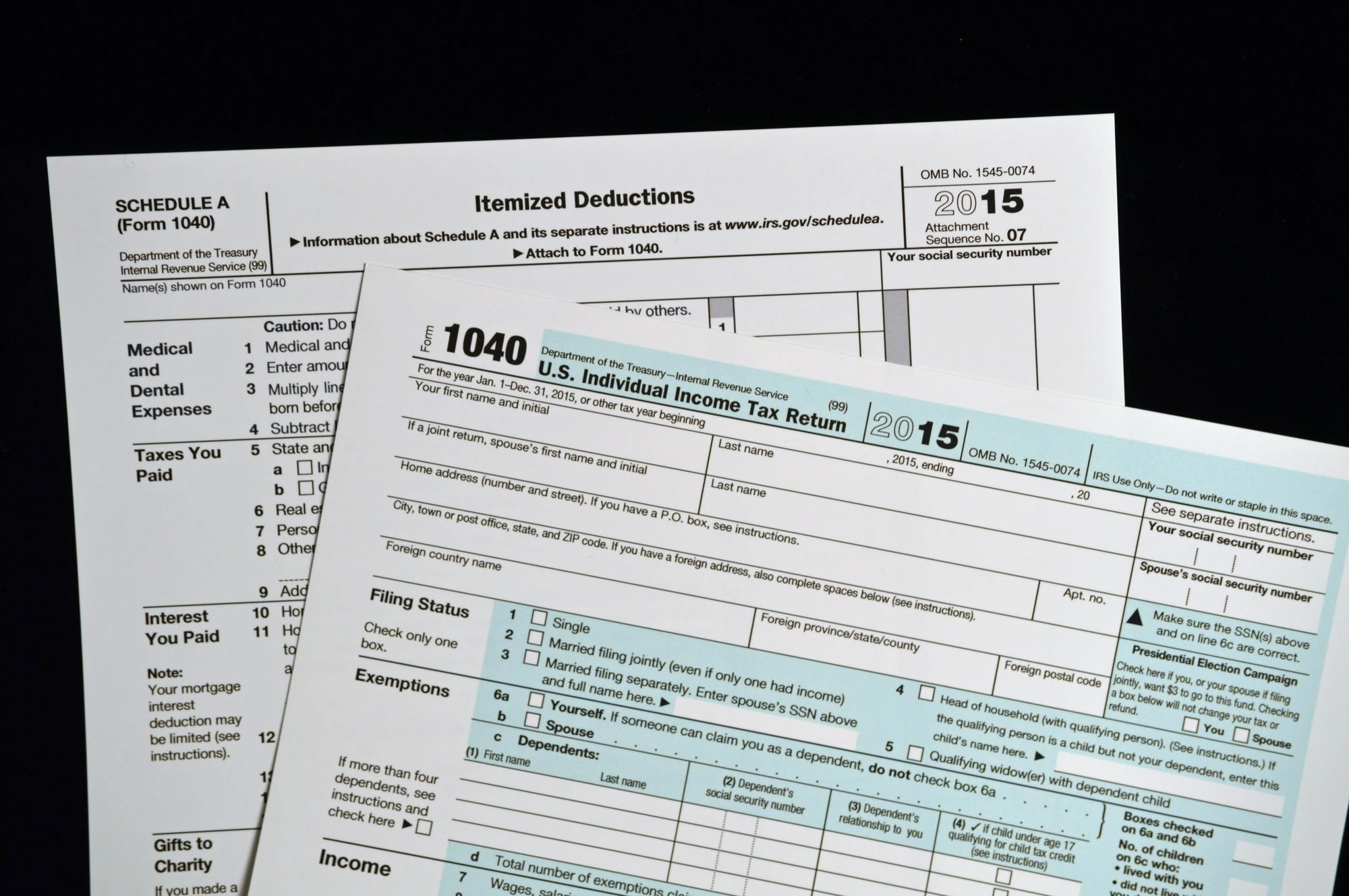

Before the new law, miscellaneous deductions were still deductible. These were items like work-related travel, union dues, and student loans. But after the new law, miscellaneous deductions are no longer deductible for federal tax purposes. While miscellaneous deductions are still permitted in many states, they are not allowed to be claimed for federal tax purposes. These expenses are listed on Schedule A of Form 1040.

Most taxpayers take the standard deduction. However, it is worth determining the benefits of itemizing your deductions. Take our quiz to see if itemizing is right for you for the 2021 tax year. Then, take a look at your financial situation. If you’re a single mother and rent an apartment, you don’t have enough tax deductions to itemize. If you’re a couple, you can deduct your mortgage interest, but you’ll probably still receive a higher standard deduction.

A good way to find out if itemized deductions are worth your time is to check your tax returns from past years. In addition to your prior years’ tax returns, you can also look at your estimated income and itemized deductions to see how much they’ve increased. For example, Mark and Sara expect to make a similar amount in 2021. So, they look at their Form 1040 and see that they earned $100,000 of income in the same period.

Another way to lower your tax bill is to take advantage of the standard deduction. As long as you meet the eligibility requirements, you should be able to take advantage of this tax break. There are some types of interest you can deduct, as long as they’re paid on the property you’re buying. These are generally higher than the standard deduction, but you can’t go over the limit. If you have enough investment interest to use for an itemized deduction, you should definitely take it.

If you’ve got a higher income than the standard deduction, itemizing deductions may be a good way to reduce your tax bill. It will help you to save money and increase your take-home pay. As long as you can document all of your expenses, itemizing deductions can lower your tax bill. You can also use tax credits and deductions in conjunction to reduce your tax burden. You might end up owing zero federal income tax!